Table of Content

Some types of investments pay out interest twice every year, for example. In those instances, you’ll need to subtract the interest you’ll earn before the maturity date from the maturity value in order to see how much you’ll actually receive in your final payment. In other words, when the maturity date arrives, you’ll usually only get one extra interest payment plus the initial principal on the maturity date itself. If you are using this formula to calculate the return you’ll get from investing in a debt instrument, it’s important to note that the maturity value will give you the return you’ll get overall. Whether you’ll receive all of it on the maturity date will depend on the type of investment.

Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first.

Importance of possession certificate concerning home loans

Her work has most recently appeared in Bankrate, MoneyWise and Investopedia. Rae specializes in credit card rewards, investing, real estate, home improvement, lending and financial advice for millennials, Gen Z, Gen Alpha and their parents. If you have purchased a flat during the construction phase, the builder will provide you the possession letter. If you have purschased a resale flat, the agreement date on index II is valid evidence of possession. The house should be ready for intended use to claim the deduction under section 24. The deduction is allowed for the whole financial year in which the flat is ready for use.

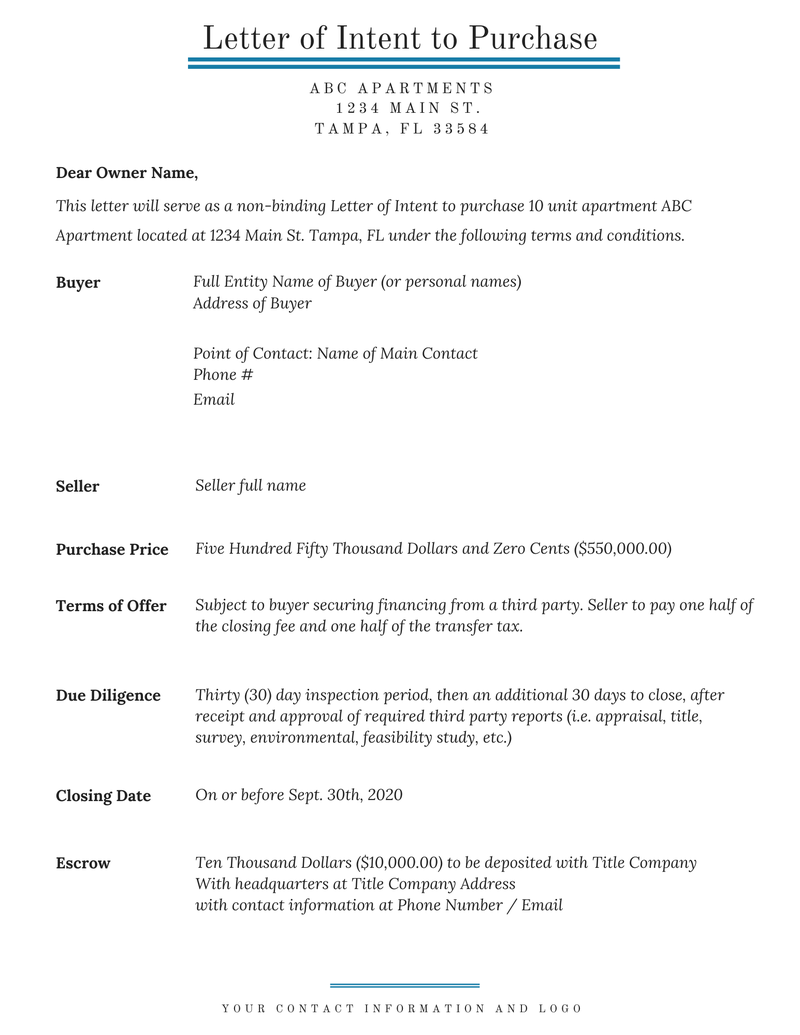

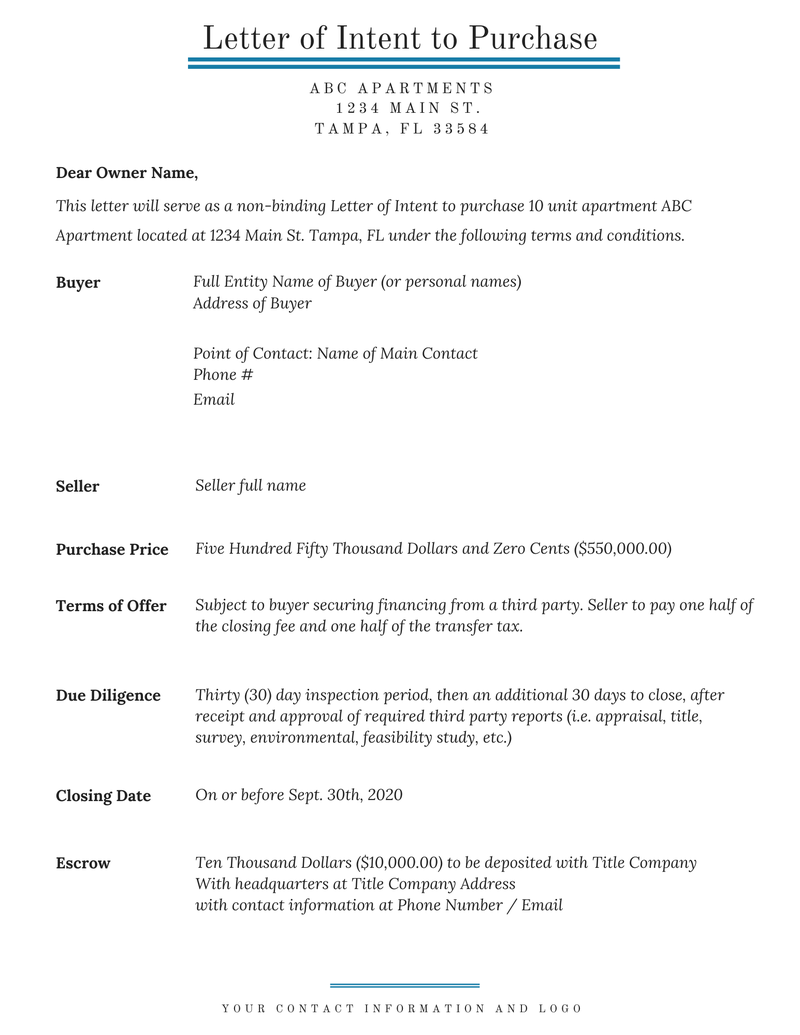

Whether you’re thinking of becoming a borrower or a lender, the maturity date on a loan is a key piece of information to know. Maturity dates come into play whether you’re attempting to pay off a loan or cash in an investment like a government bond. We’ll give you a crash course in what a loan maturity date is and what you need to know about it. The buyer is also entitled to receive the reimbursement of the money to impose the specific performance of the contract, where the seller has not delivered the property.

Home loan calculators

A Tahsildar is a gazetted officer who is in charge of the matters related to land, tax, and revenue. In order to get a possession certificate in rural areas you have to approach the concerned Tahsildar’s office. When purchasing a piece of residential real estate, you almost always gain ownership of the property — aka having title to it — at the same time you take possession of it. However, if you are purchasing a property that you immediately rent out, you take ownership of the property, but you don’t possess it. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate.

Commencement Date means the date fourteen days after the date the Contract comes into effect or any other date named in the Contract Data. The commencement date means the date on which the Contract shall take effect, as notified by the Authority to the Contractor in a letter awarding the Contract. In neutral markets, possession typically changes hands upon closing. Possession typically changes hands upon closing, but market conditions can influence this a bit. Elizabeth Weintraub is a nationally recognized expert in real estate, titles, and escrow. She is a licensed Realtor and broker with more than 40 years of experience in titles and escrow.

What is a Conditional Possession Letter?

If, on the other hand, you’re the lender then maturity dates tend to be a lot more fun. In this case, your loan’s maturity date means that the borrower has to repay you your principal, plus any interest owed. The certificate contains the following things such as the description of the property and the required add-ons like parking space, garage, etc. as agreed upon in the contract of sale.

In a real estate purchase, the buyer and seller draw up a purchase and sale agreement for the property. Items on the agreement that are subject to negotiation include the purchase price, seller assistance with closing costs, the closing date, and fixtures . Rae Hartley Beck is a writer and editor with over eight years of experience in personal finance.

Types of Home Loan

Possession letter won’t affirm you as the rightful owner of the property. This certificate is issued by the local authorities certifying that the construction work has been completed as per the approved plan and the building is ready for occupation. It also states that the property has been constructed in adherence to the local laws. Possession certificate or letter is an important document that the seller has to produce to the buyer stating the date of possession.

When she's not writing, you can find her fixing up her cabin in the Catskills. The possession date is typically set during negotiations and is included in the real estate contract, along with the closing date and any other important milestone dates or conditions the parties need to meet. A buyer may also opt to lease the home back to the seller for a period of time after closing. The parties may choose a possession date that falls immediately after closing, or after a certain timeframe such as 15, 30, or 60 days after closing.

It's crucial all parties in a real estate transaction clearly communicate about the possession date before they finalize their sales contract. Your agent can help you navigate any local laws that could impact this arrangement so you can be informed when you negotiate the details. Don't let possession issues cause one last headache before you close the deal. Your contract can spell out precisely when occupancy is permitted, yet the transaction might not close on time.

If the home rates poorly on any of these items, the buyer may lose their financing. To save the deal, the buyer and seller may be able to renegotiate the terms. Chelsea Levinson, JD, is an award-winning content creator with expertise in real estate, mortgage, and personal finance.

AskMoney.com and any content or offers listed herein are not an intermediary, broker/dealer, investment advisor, or exchange and do not provide investment advice or investment advisory services. For this reason, you may be able to save yourself some money if you’re able to pay off a loan before the maturity date. Since the lender will no longer be able to collect interest from you, however, you’ll want to check to make sure that they don’t impose early payment fees. If they do, you’ll want to compare them to the amount of money you’d save by dodging the remaining interest payments. The contents of this article/infographic/picture/video are meant solely for information purposes. The contents are generic in nature and for informational purposes only.

Term Commencement Date shall be the latest of the day Landlord tenders possession of the Premises to Tenant with all Tenant Improvements Substantially Completed and January 1, 2008. If possession is delayed by action of Tenant, then the Term Commencement Date shall be the date Tenant Improvements are Substantially Complete. Failure to execute and deliver such acknowledgment, however, shall not affect the Term Commencement Date or Landlord’s or Tenant’s liability hereunder. Failure by Tenant to obtain validation by any medical review board or other similar governmental licensing of the Premises required for the Permitted Use by Tenant shall not serve to extend the Term Commencement Date. Be sure not to agree to a rent-back lease agreement of longer than 60 days.

Later possession dates and lease-back agreements are more common in seller’s markets where buyers often make concessions to beat out the competition. In buyer’s markets, the buyer tends to have more negotiating power to get an immediate move-in date. However, note that lease-backs longer than 60 days may cause the lender to view the home as an investment property, and charge the buyer a higher mortgage rate. Note that your possession date may or may not be the same as closing day.

No comments:

Post a Comment